Introduction

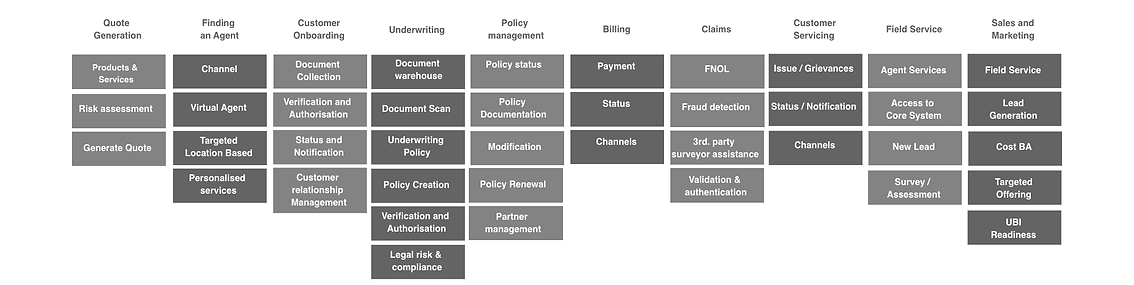

Insurance providers lacking digital channels face significant challenges in selling their products. For instance, customers purchasing a new policy often undergo multiple interactions with agents to finalize the right product. After selecting a suitable policy, they must manually submit their documents or send them via email for onboarding. Subsequently, the laborious underwriting process begins, involving various assessments such as health, property, car, and financials based on the product type. Finally, the customer must make the initial payment. This lengthy and manual process presents obstacles in the customer journey. Modern insurance providers offering streamlined processes and minimal physical interventions have a competitive edge in attracting customers.

Brief : To create a new generation insurance service, with digital interventions and pitch ideas to the insurer market on what is possible.

Process

Studying existing

insurance market

in target geography

Learning traditional user journey and digital landscape

Understanding actors involved

Identifying painpoints of the actors

Creating service blueprint

Finding oppurtunities to digitalize and points of departure

Prototype

creation

Interaction Design

Wireframing

Ideating on various interfaces

The demand for contact-free interactions is on the rise, surpassing traditional human-based personalized experiences. Insurers are increasingly prioritizing the development of this capability to better serve their customers. This transformation promises to save time, enhance personalization, and boost profit margins for insurance providers.

Actor identification

The agent needs to provide the best customer service experience and also assist the customer in various queries and grievances sucessfully.

Insurance purchaser needs to be wooed by the insurance agents and insurance service provider. He also needs to provide necessary documents and pay the premium without hassle.

Surveyor is in charge of verifying and surveying the property in case of a claim. He holds a very important role in decision making authentication of claim and payment of the claims

An insurance company who wants to save time and resource in handling business and provide customers and employees with the latest solutions to create and maintain business and experience.

Pain points

Service blueprint

Opportunity whiteboarding

Prototype Offerings

Customer application

-

Easy management of insurance profile and properties.

-

View and download policy details

-

Pay premium online

-

File and manage claim

-

Clear all doubts through FAQ Bot

-

Contact agent/ call center easily

Catastrophe notification and claiming

-

Notified easily about the upcoming catastrophe/ weather scenario.

-

Get DIY details on how to safeguard your property

-

Get immediate assistance in case of emergency.

-

File claim by authentication of AR property marker placed on the location.

-

Fill all details online quickly with most form fields prefilled for ease

-

Schedule surveyor on your preferred time for quick claim remuneration.

Omnichannel claiming allows users to submit claims seamlessly across various channels. Users can initiate a claim online through the website, verifying their identity via OTP authentication. Additionally, they have the flexibility to save their claim draft and continue the process on their mobile or tablet device, ensuring a convenient and efficient experience.

Surveyor application

-

Authentication of the surveyor with a digital handshake

-

Surveyor gets the heads up on possible survey areas based on the preemptive notification

-

Surveyor receives schedule based on his calendar availability which he can then accept or delegate

-

Surveyor can fill a survey form on the app even in offline mode and save draft.

-

He can upload pictures and videos to cross-reference and authenticate.

-

The survey form directly goes to the insurer with claim value which then can be quickly processed.

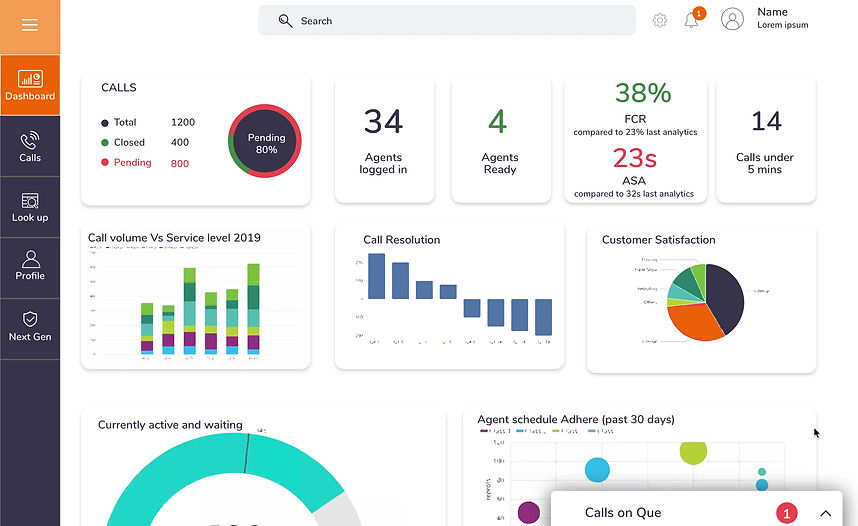

The contact center offers comprehensive analytics and real-time insights, ensuring efficient operations. With 24/7 live support, customers receive assistance whenever needed. Context maintenance ensures seamless transitions between interactions. Features like call deflection and reduction enablement optimize resources. Additionally, the focus is on resolving first contact issues promptly, supported by sentiment analysis for better service delivery.